One-Stop Solution for Centralizing Lease Contracts

Ensure Lease Contracts Comply With IFRS16, ANC 2020-01, and IAS17 Standards

"*" indicates required fields

How Efficient is Your Leasing Contracts Management?

New IFRS16 Requirements are Too Complex

The new IFRS16 standards require companies to report information for all their leased assets in a standardized and transparent manner. This puts significant strain on companies to ensure compliance.

Manual Processes Waste Time

For many companies, contract volumes are too large to be managed in spreadsheets and they require a more scalable solution. With their spreadsheet-based solutions, organizations struggle to validate compliance with the legal requirements of the IFRS16, ANC 2020-01, and IAS17 standards.

Limited Traceability and Analytics

Current solutions do not allow rental contracts to be managed centrally for traceable historical data to ensure IFRS16 compliance, nor do they provide the ability to produce impact analyses on lease contracts.

Trusted By

Streamlined Lease Contracts for all Subsidiaries

Viareport Lease is a big time-saver thanks to its flexible, user-friendly interface. It optimizes lease contract management processes by providing security, automatic processing, sharing, analysis, traceability, compliance, and interfacing abilities with your consolidation or accounting system. It can quickly automate your manual leasing processes and its multi-language capabilities make for a smooth deployment in multi-national organizations.

Manage Changes Quickly and Efficiently

Viareport Lease is a scalable solution designed to support the needs of larger organizations. As such, it can manage over 100,000 active leases and offers rich operational capabilities, such as easy integration, streamlined restatement preparation, and multi-dimensional analysis for consolidated accounts. As a cloud solution, Viareport Lease is regularly enriched with new capabilities and adapts continuously to the evolution of leasing standards.

Ensure IFRS16 Compliance

Viareport Lease was created specifically for IFRS16 compliance, and as a result, has dual CRC 99-02 and IFRS settings regularly updated by our standards and methods unit. This enables users to validate compliance with IFRS16 requirements, such as the valuation of rental debt, restatements, COVID amendments, etc.

BEST-IN-CLASS FEATURES

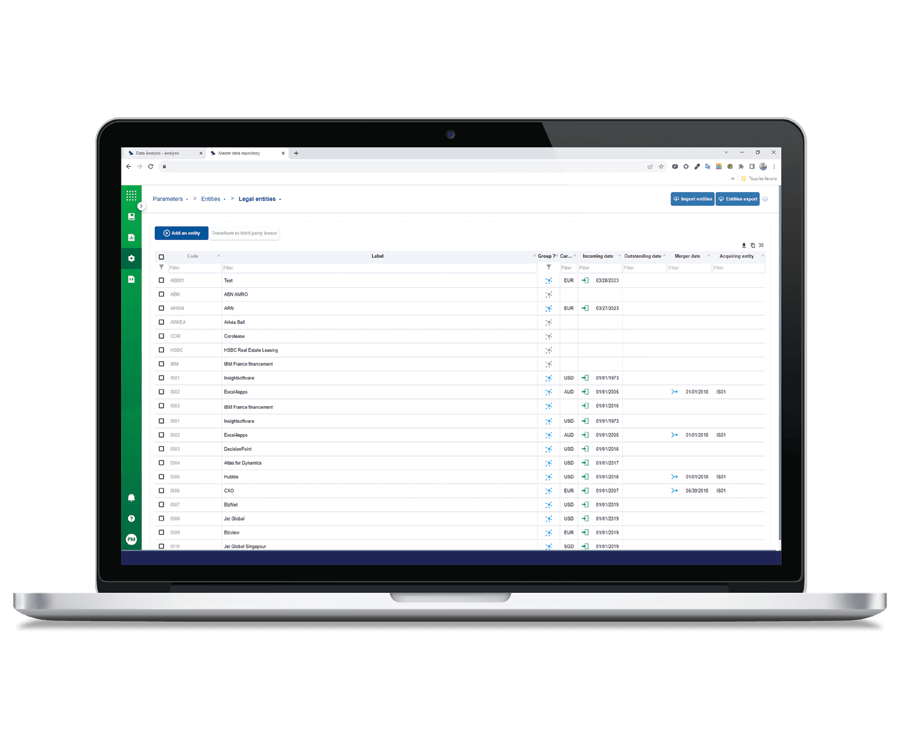

Centralized Lease Contracts

Utilize a single source of truth to save time and effort

- Centralize lease contracts for all subsidiaries to manage and monitor changes.

- Perform batch retrieval of historical data imported from Excel files.

- Manage errors and monitor payments within a single program.

- Supports multi-currency retrieval capabilities as well as multilingual UI that enable multinational. organizations to centrally manage lease contracts across multiple jurisdictions.

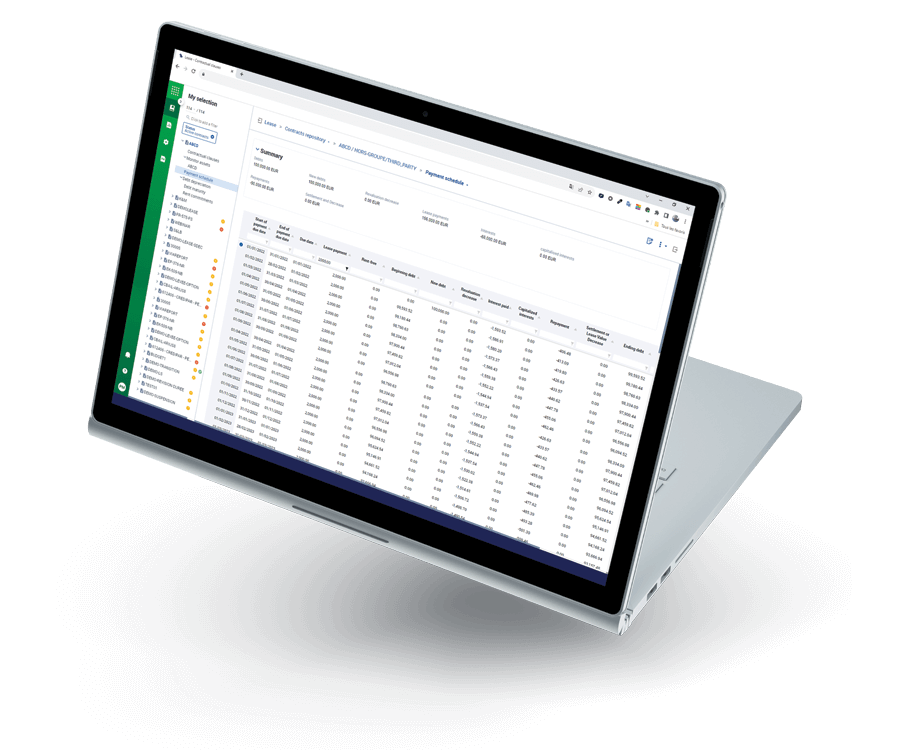

Scalable Solution

Ensure your solution grows with your company’s needs

- Extended functional coverage and technical performance enables support for larger organizations.

- Ability to manage over 100,000 active leases.

- Rich operational capabilities, such as easy integration and streamlined restatement preparation make it simple to use.

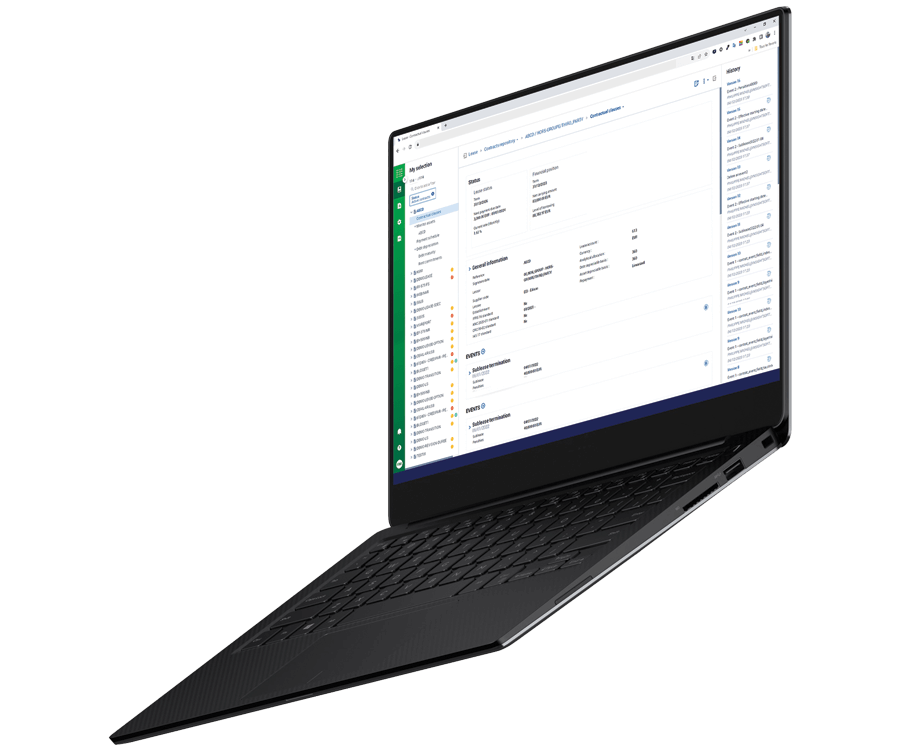

Improved Transparency

Provide the transparency required by today’s regulations

- Interface ability to monitor any changes which provides greater transparency required by IFRS16.

- Monitor initial conditions, add events to the lease lifecycle, and generate consolidation entries in a customizable environment.

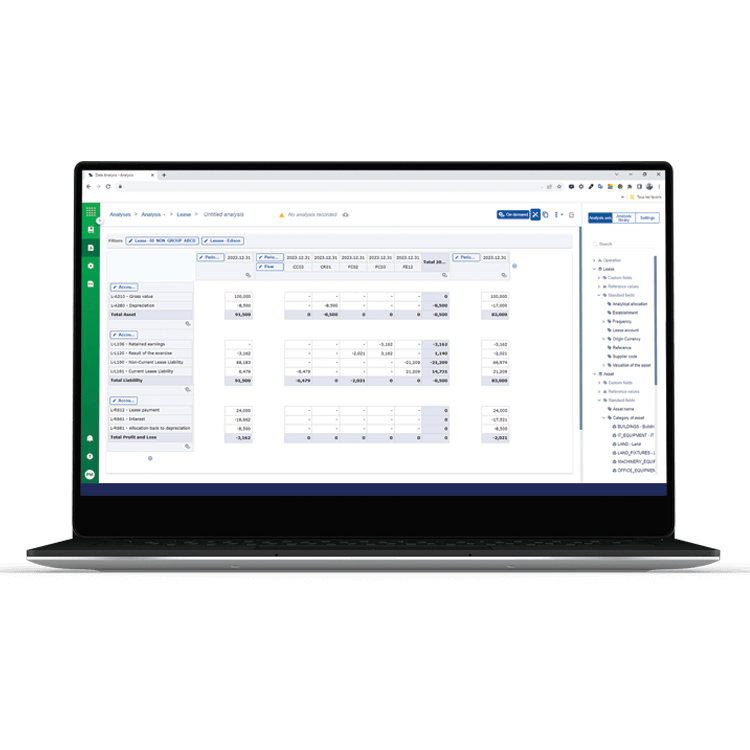

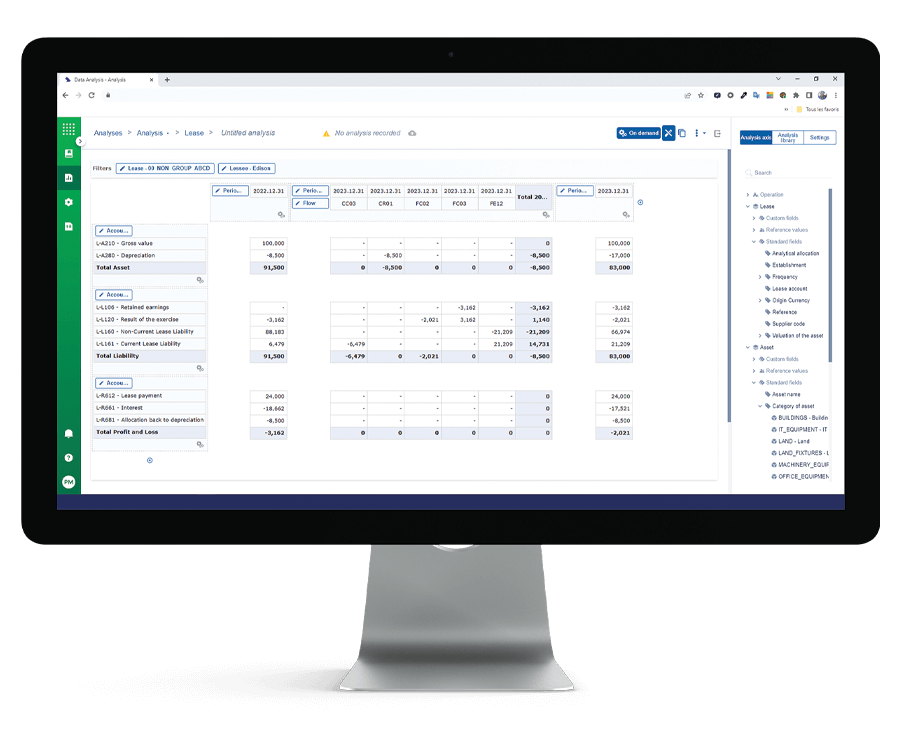

Multi-Dimensional Analytics

Analyze impact on current and projected contracts

- Link narrative and data in reports directly back to source data to ensure there are no conflicting numbers or narrative anywhere in a report

- Automatically cascade changes to source numbers through all reports to ensure a single version of the truth and eliminate human error

Ready to go beyond Close & Consolidation?

Viareport Lease is one of insightsoftware's unified, modular applications. Select the capabilities you need across budgeting & planning, controllership, and reporting to get more done with less risk by bringing all your insightsoftware applications together in one place.

Work with the #1 Reporting Vendor for ERPs and EPMs

We needed a tool that could allow us to import numerous contracts at once, and then automatically transfer the updated data to our consolidation software. It was way too complicated for us to do it manually. The software is very user-friendly, our team members did not need any specific training.

Speak to an Expert